Cryptocurrencies started with just one coin, Bitcoin, back in 2009. Now in 2025, there are more than 17,000 of them in the market.

Still, only a few really hold value. Bitcoin and Ethereum together make up nearly 75% of the total market. The overall crypto market cap is about $3.78 trillion, which shows how big—but also how unpredictable—it has become.

More than half of all coins have already failed, yet new ones keep coming as people continue to experiment and build. Big names like Binance lead most of the trading today.

Around 28% of American adults now own some form of digital asset. With more people joining in, cryptocurrencies are slowly changing how money and finance work around the world.

Top Picks: How Many Cryptocurrencies Are There?

- As of 2025, 17151 cryptocurrencies are in existence. (Coin Gecko) However, the majority have low market significance.

- Bitcoin and Ethereum together account for nearly 75% of the total cryptocurrency market cap, highlighting the market’s concentration.

- As of 2025, Bitcoin (BTC) remains a “high cap” asset, with a market capitalization exceeding $10 billion, signifying its dominance in the crypto space. (Statista)

- 217 cryptocurrency exchanges exist worldwide in 2025. (Coin Gecko)

- The global cryptocurrency market cap stands at $3.78 trillion, reflecting both rapid growth and extreme volatility. (Coin Gecko)

- The worldwide cryptocurrency market is expected to generate $45.3 billion in revenue in 2025. The penetration rate is estimated at 11.02% worldwide by the end of 2025. (Statista)

- As of 2025, over 50% of all cryptocurrencies have failed. (Coin Gecko)

How Many Cryptocurrency Exchanges Are There?

- As of 2025, there are 217 cryptocurrency exchanges worldwide.

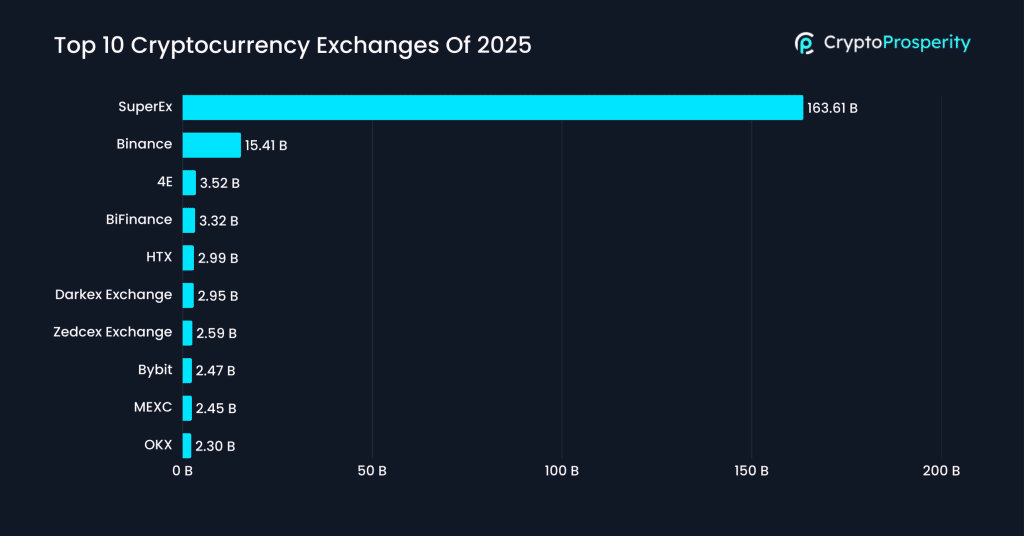

SuperEx is the largest cryptocurrency spot exchange in the world by trading volume, with $156.99 billion in trades within 24 hours. Binance, once the dominant exchange, ranks second with $15.41 billion in 24-hour trading volume.

Here’s a table of the top 10 cryptocurrency exchanges based on 24-hour trading volume as of 2025:

| Exchange | 24h Trading Volume (in Billion USD) |

|---|---|

| SuperEx | 156.99 |

| Binance | 23 |

| 4E | 1.05 |

| BiFinance | 2.88 |

| HTX | 3.88 |

| Darkex Exchange | 5.22 |

| Zedcex Exchange | 2.87 |

| Bybit | 4.89 |

| MEXC | 5.14 |

| OKX | 4.27 |

Cryptocurrency Market Size (2025-2030)

- As of 2025, the global cryptocurrency market cap today is $3.78 trillion.

- The peak Cryptocurrency market cap appears to be around $4 trillion, reached in late 2024.

- The lowest market cap in the last decade was before 2017, when the total market cap remained under $100 billion.

Here is a year-wise breakdown of the total cryptocurrency market capitalization:

| Year | Approx. Cryptocurrency Market Cap |

|---|---|

| 2015 | <$10 billion |

| 2016 | ~$15 billion |

| 2017 | ~$600 billion (Dec peak) |

| 2018 | ~$130 billion (Bear market low) |

| 2019 | ~$250 billion |

| 2020 | ~$750 billion (End of year) |

| 2021 | ~$3 trillion (Nov peak) |

| 2022 | ~$800 billion (Bear market low) |

| 2023 | ~$1.8 trillion |

| 2024 | ~$4 trillion (Peak) |

| 2025 | ~$3.78 trillion (Current) |

- By 2030, the cryptocurrency market is expected to reach USD 69.39 billion, reflecting a compound annual growth rate (CAGR) of 7.11%. (Mordor Intelligence)

Growth Of Crypto Coins Over The Years

- The global cryptocurrency user base grew the most by nearly 190% between 2018 and 2020. (Statista)

- As of January 30, 2025, Bitcoin (BTC) reached a price of $105,510, marking a 12.5% increase over the past 30 days. 30 days ago, Bitcoin was approximately $93,800.

- Ethereum (ETH) was priced at $3,890.33, reflecting a 7.42% drop in the past month.

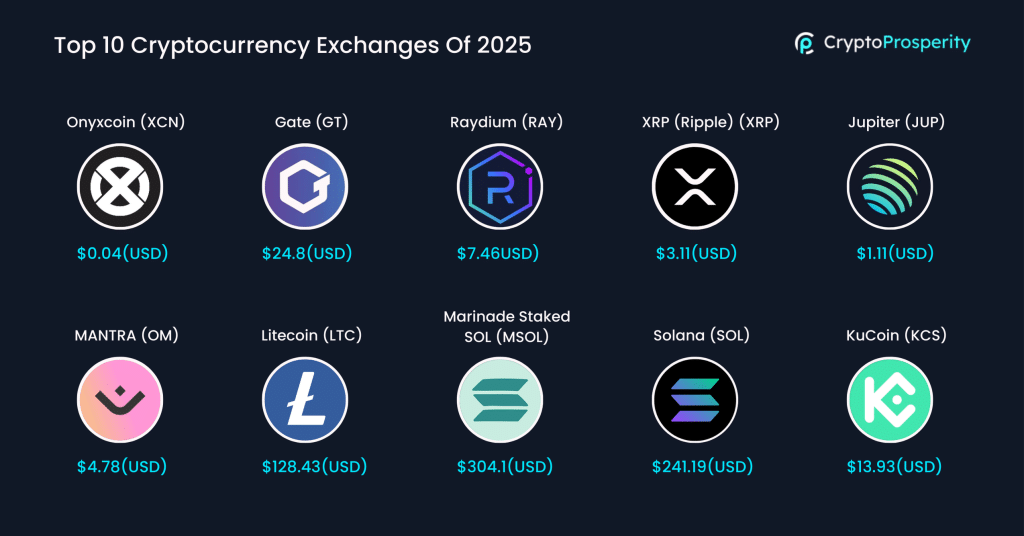

Top 10 Performing Cryptocurrencies (30-Day Change) as of January 30, 2025:

| Rank | Cryptocurrency (Symbol) | Price (USD) | 30-Day % Change |

|---|---|---|---|

| 1 | Onyxcoin (XCN) | $0.04 | +1,550.7% |

| 2 | Gate (GT) | $24.8 | +55.1% |

| 3 | Raydium (RAY) | $7.46 | +51.7% |

| 4 | XRP (Ripple) (XRP) | $3.11 | +50.8% |

| 5 | Jupiter (JUP) | $1.11 | +35.3% |

| 6 | MANTRA (OM) | $4.78 | +34.2% |

| 7 | Litecoin (LTC) | $128.43 | +28.6% |

| 8 | Marinade Staked SOL (MSOL) | $304.1 | +26.7% |

| 9 | Solana (SOL) | $241.19 | +25.8% |

| 10 | KuCoin (KCS) | $13.93 | +30.0% |

(Statista)

- Bitcoin remains the most widely held cryptocurrency, owned by 74% of crypto investors.

- Ethereum ownership has declined from 65% in 2022 to 49% in 2025.

- Dogecoin ownership has increased to 31%, surpassing Solana (18%) and USDC (17%).

- 66% of people planning to buy crypto in 2025 want Bitcoin, followed by Ethereum (43%) and Dogecoin (24%).

- Solana has gained traction, with 17% of crypto buyers planning to invest in it this year.

- Ethereum recorded over 39 million on-chain transactions in December 2024, making it the most-used cryptocurrency that month.

- Bitcoin processed 12.7 million transactions in the same period, about one-third of Ethereum’s transaction volume.

(Statista)

Types of Cryptocurrency & Their Statistics

There are 12 types of Cryptocurrencies, and here are statistical facts about them:

1. Payment Cryptocurrencies

These are designed to function as digital money for transactions. (Examples: Bitcoin (BTC), Litecoin (LTC), Bitcoin Cash (BCH), Dash (DASH))

- Bitcoin (BTC) remains the largest payment-focused cryptocurrency, with a market cap of $2.16 trillion as of October 2025.

- Litecoin (LTC), often called the silver to Bitcoin’s gold, has a total supply of 84 million coins, four times that of Bitcoin.

2. Stablecoins

These are pegged to a stable asset like the U.S. dollar to minimize volatility. Examples: Tether (USDT), USD Coin (USDC), Dai (DAI), Binance USD (BUSD)

- Tether (USDT) is the most dominant stablecoin, with a market cap of $142.69 billion, making it the fourth-largest cryptocurrency overall.

- USD Coin (USDC) holds a $57.23 billion market cap and claims to be 100% backed by reserves.

3. Smart Contract Platforms

(These blockchains support decentralized applications (DApps) and automated contracts. Examples: Ethereum (ETH), Solana (SOL), Cardano (ADA), Avalanche (AVAX)

- Ethereum (ETH) leads this category with a $264.67 billion market cap and processes over 1 million transactions daily.

- Solana (SOL) boasts 65,000 transactions per second (TPS), making it one of the fastest blockchain networks.

4. Privacy Coins

These focus on enhanced anonymity and untraceable transactions. Examples: Monero (XMR), Zcash (ZEC), Dash (DASH), Verge (XVG)

- Monero (XMR) transactions are fully anonymous, with over 95% of transactions on its network being shielded from public view.

- Zcash (ZEC) offers optional privacy features and has been used in over 20 million transactions since its launch.

5. Utility Tokens

These provide access to specific services within a blockchain network. Examples: Chainlink (LINK), Binance Coin (BNB), Uniswap (UNI), Filecoin (FIL)

- Binance Coin (BNB) has a market cap of $84.33 billion and is widely used for trading fee discounts on Binance.

- Chainlink (LINK), a leading oracle network, has facilitated over $500 billion in innovative contract transactions.

6. Governance Tokens

These allow holders to vote on changes to a blockchain’s protocol. Examples: Maker (MKR), Aave (AAVE), Compound (COMP), Curve DAO (CRV)

- Maker (MKR) holders manage over $8 billion in assets within the MakerDAO ecosystem.

- Aave (AAVE) governance decisions impact a DeFi lending market worth over $10 billion.

7. Exchange Tokens

Issued by cryptocurrency exchanges, these tokens provide trading fee discounts and rewards. Examples: Binance Coin (BNB), FTX Token (FTT), OKB (OKB), KuCoin Token (KCS)

- Binance Coin (BNB) is the most valuable exchange token, worth $84.33 billion, and it is used for transaction discounts and payments.

- OKB (OKX Exchange token) has seen over 200% price growth in the last two years.

8. Meme Coins

These started as jokes but have gained value due to community support. Examples: Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Floki Inu (FLOKI)

- Dogecoin (DOGE), originally a joke, now has a market cap of $29.84 billion and is used for payments, including Tesla merchandise.

- Shiba Inu (SHIB) has over 1.3 million holders, making it one of the most widely held meme tokens.

9. Gaming & Metaverse Tokens

Used in virtual worlds, gaming platforms, and NFT-based economies. Examples: Decentraland (MANA), Axie Infinity (AXS), The Sandbox (SAND), Gala (GALA)

- Since its launch, the Sandbox (SAND) has powered $500 million worth of virtual land sales.

- Axie Infinity (AXS) once processed $3 billion in NFT transactions in a year.

10. Layer 2 & Scaling Solutions

These improve blockchain efficiency by reducing transaction costs and congestion. Examples: Polygon (MATIC), Optimism (OP), Arbitrum (ARB), Loopring (LRC)

- Polygon (MATIC) processes more than 2.3 million daily transactions, reducing Ethereum gas fees significantly.

- Arbitrum (ARB) holds over $10 billion in total value locked (TVL) in DeFi protocols.

11. Central Bank Digital Currencies (CBDCs)

Government-issued digital currencies backed by national banks. Examples: Digital Yuan (e-CNY), Digital Euro, Digital Rupee, FedNow (U.S. proposal)

- China’s Digital Yuan (e-CNY) has over 260 million users and has completed $14 billion worth of transactions.

- More than 130 countries are exploring CBDCs, representing 98% of the global GDP.

12. Asset-Backed & Commodity Tokens

These represent ownership of real-world assets like gold, real estate, or stocks. Examples: Paxos Gold (PAXG), Tether Gold (XAUT), Synthetix (SNX), Wrapped Bitcoin (WBTC)

- Paxos Gold (PAXG) represents over $500 million in gold-backed assets on the blockchain.

- Wrapped Bitcoin (WBTC) has a circulating supply of over 160,000 BTC, bridging Bitcoin to Ethereum-based DeFi platforms.

(Coin Market, Coin Gecko, Etherescan, Bankrate, DefiLlama, PBC)

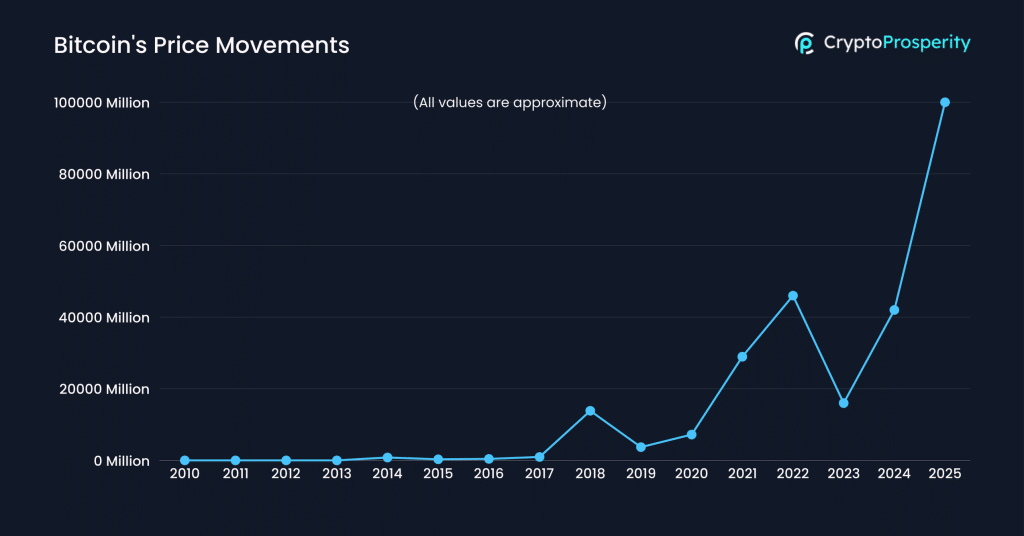

When Was Bitcoin Launched? (Bitcoin Statistics)

- Bitcoin was officially launched on January 3, 2009, by Satoshi Nakamoto, an anonymous creator or group.

- Bitcoin has seen multiple boom-and-bust cycles, often dropping 50-90% before rebounding stronger.

- In December 2024, Bitcoin crossed $100,000 for the first time, thanks to Donald Trump’s pro-crypto policies after his reelection.

- However, Bitcoin faced volatility in early 2025, dropping after announcing a Strategic Bitcoin Reserve.

- Bitcoin broke $100 for the first time in April 2013 and surged to over $1,200 by December.

- A 90% crash followed in 2014, largely due to the infamous Mt. Gox exchange collapse, dropping Bitcoin to $111 before rebounding to $430 by 2015.

- By 2017, Bitcoin skyrocketed past $10,000 in November, peaking at $19,000+ in December due to mainstream investor interest and hype.

Here’s a year-wise table summarizing Bitcoin’s historical price movements and returns:

| Year | Price at Start | Price at End | Return (%) |

|---|---|---|---|

| 2009 | N/A | N/A | N/A |

| 2010 | ~$0.00099 | ~$0.30 | 30,203%* |

| 2011 | ~$0.30 | ~$4.70 | 1,467% |

| 2012 | ~$4.70 | ~$13.50 | 187% |

| 2013 | ~$13.50 | ~$805 | 5,870% |

| 2014 | ~$805 | ~$318 | -61% |

| 2015 | ~$318 | ~$430 | 35% |

| 2016 | ~$430 | ~$960 | 124% |

| 2017 | ~$960 | ~$13,850 | 1,338% |

| 2018 | ~$13,850 | ~$3,709 | -73% |

| 2019 | ~$3,709 | ~$7,200 | 94% |

| 2020 | ~$7,200 | ~$28,949 | 302% |

| 2021 | ~$28,949 | ~$46,000 | 60% |

| 2022 | ~$46,000 | ~$16,000 | -65% |

| 2023 | ~$16,000 | ~$42,000 | 163% |

| 2024 | ~$42,000 | ~$100,000+ | 138%+ |

| 2025 | ~$100,000+ | N/A | N/A |

Crypto Usage Demographics

- 28% of American adults (65 million people) own cryptocurrency in 2025, nearly doubling from 15% in 2021.

- 67% of crypto owners are men, while 33% are women.

- The median age of crypto owners is 45.

- 14% of non-owners plan to enter the crypto market in 2025, and 48% are open to doing so.

- 67% of current crypto holders plan to buy more this year.

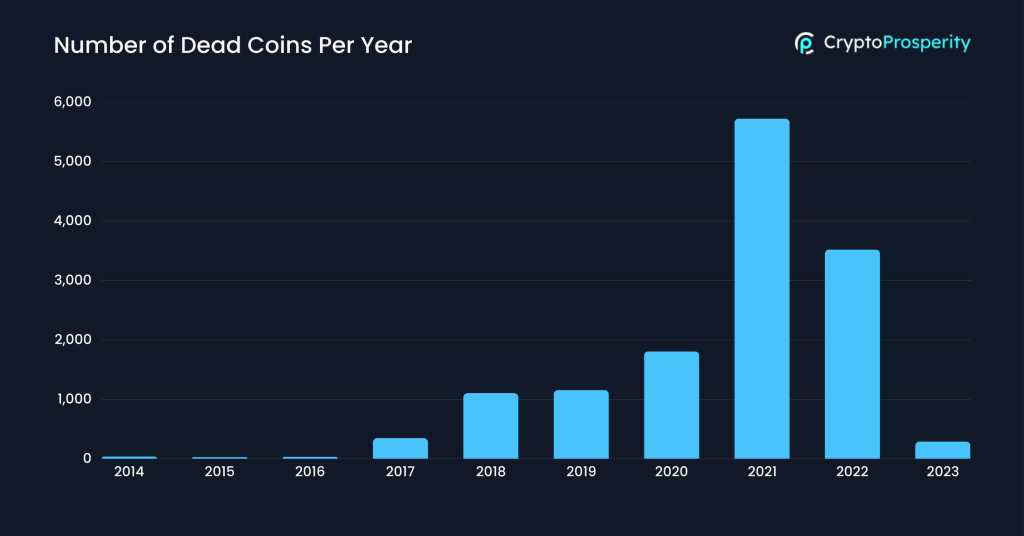

How Many Cryptocurrencies Have Failed?

- Over 50% of Cryptocurrencies Have Failed.

- Since 2014, 14,039 of 24,000+ cryptocurrencies listed on CoinGecko have become inactive or “dead.”

- 2021 had the most Cryptocurrencies failures (5,724 projects dead, ~70% failure rate).

Here’s a table summarizing the cryptocurrency failure data:

| Year of Launch | Number of Dead Coins | Failure Rate |

|---|---|---|

| 2014 | 37 | Low |

| 2015 | 27 | Low |

| 2016 | 32 | Low |

| 2017 | 346 | ~70% |

| 2018 | 1,104 | ~70% |

| 2019 | 1,154 | Moderate |

| 2020 | 1,806 | Moderate |

| 2021 | 5,724 | ~70% |

| 2022 | 3,520 | ~60% |

| 2023 | 289 | <10% |

Crypto Concerns in 2025

- 59% of people familiar with crypto lack confidence in its security, including 40% of crypto owners.

- Nearly 1 in 5 crypto owners have struggled to withdraw funds from custodial platforms.

- 39% of non-owners cite unstable value as their top concern, while 32% of owners fear cyberattacks.

- 93% of respondents are based in Europe, Asia, North America, and Africa, highlighting global interest in Crypto AI.

- 53% of participants are in their first crypto cycle (0-3 years in crypto), indicating that many respondents are relatively new to the space.

- In 2025, 51% of crypto users identified as long-term investors, while 26% were short-term traders.

The Future of Cryptocurrencies

- Cryptocurrency adoption in payments remains minimal, with forecasts predicting it will account for only 0.2% of global transaction value by 2027. (Statista)

- The number of cryptocurrency users is projected to reach 861.01 million in 2025. However, the penetration rate is estimated at 11.02% worldwide in 2025.

- The United States will contribute the highest revenue, projected at $9.4 billion by the end of 2025.

(Statista)

Also Read:

Will Crypto Change Under the Trump Administration?

- 60% of Americans familiar with crypto expect its value to increase under Trump’s presidency.

- 46% believe Trump will boost mainstream adoption of cryptocurrency.

- 28% support the creation of a national Bitcoin reserve, rising to 44% among current crypto owners.

- Only 24% trust the government to regulate cryptocurrencies effectively.