As Bitcoin prices fluctuate and economic conditions evolve, many crypto holders wonder, “Should I sell my Bitcoin?”. The answer isn’t one-size-fits-all.

Your decision should depend on your investment goals, market trends, upcoming events like Bitcoin halving, and your risk appetite.

This guide breaks down various scenarios, search trends, and expert insights to help you make a more informed choice.

If you’re a long-term believer in crypto or a savvy trader, timing is everything! By keeping an eye on important market indicators and considering your own financial situation, you’ll be able to make decisions you’ll feel great about later.

Let us discuss in depth further!

Is Bitcoin a Buy or Sell Right Now?

Bitcoin is still a buy. After years of watching Bitcoin, I’ve learned that if you genuinely believe this digital money revolution is just getting started, it’s still a good investment.

Think about it, major companies like Tesla and MicroStrategy have billions invested.

But if you’re the type who checks prices every hour and gets stressed about daily swings, maybe step back and avoid getting caught up in the daily drama.

Consider dollar-cost averaging rather than timing the market perfectly. Watch for regulatory developments and adoption metrics as key indicators. The asset’s volatility requires a strong stomach, but historically rewards patient investors who weather market cycles.

Should I Sell My Bitcoin in 2025?

The question “Should I sell my Bitcoin in 2025?” is becoming more common as we approach key market inflection points.

People are genuinely wondering if 2025 is the year to cash out, and honestly, there are some compelling reasons to think about it:

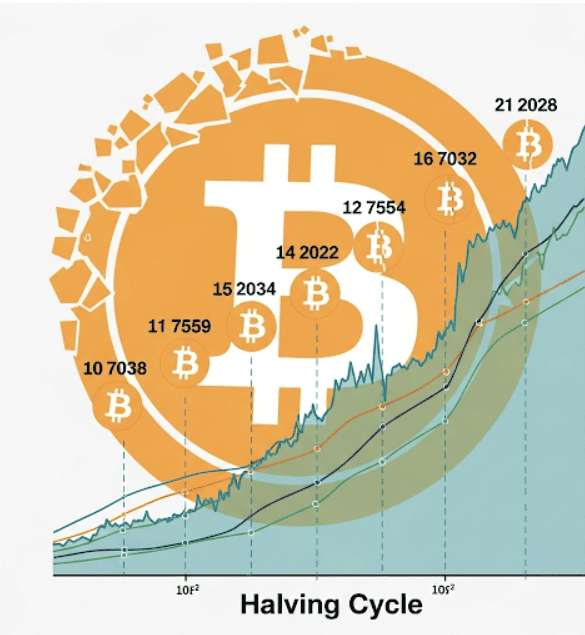

1. Post-halving price momentum:

Every four years, when Bitcoin halts mining rewards in half, something magical happens 6-18 months later. We saw it in 2017 when Bitcoin hit nearly $20,000, and again in 2021 when it touched $69,000. The 2024 halving already happened, so we’re in that sweet spot window.

2. Institutional adoption:

Just last month, I watched another billion-dollar investment firm announce a Bitcoin allocation. When BlackRock makes Bitcoin ETFs, you know institutional adoption isn’t slowing down.

3. Possible global economic instability boosting crypto demand:

With global inflation concerns and currency devaluation fears, more people see Bitcoin as “digital gold.”

If you’re nearing your investment goal, selling partially during a bull market in 2025 could be a strategic move.

If you bought Bitcoin at $10,000 and it hits $150,000 in 2025, selling 25-50% to lock in those life-changing gains might be the smartest move you ever make.

Should I Sell My Bitcoin Before the Halving?

Bitcoin halving events, when mining rewards are cut in half, historically lead to price surges after the event.

Selling before the halving might mean missing potential gains. Historical trend, In previous cycles (2012, 2016, 2020), prices increased significantly months after halving events.

If you’re holding Bitcoin now, the 2024 halving has passed, and markets are in a speculative post-halving phase. Consider holding unless you need liquidity. Many investors use halving events as opportunities to reassess their allocation strategy rather than exit points.

When to Sell Bitcoin After Halving?

Selling right after a halving may not be optimal. Historically, prices surge 6–12 months after the event. Example:

- 2020 halving: BTC was ~$8,600

- 2021: BTC peaked near $64,000

Use trailing stop-losses, set profit targets, and monitor the market closely before selling post-halving. Additionally, my strategy is never to sell everything at once.

In retrospect, after the 2020 halving, the correct strategy would have been to take 10% profits every time Bitcoin doubled. And then at $16K, sell 10%, then at $32K, another 10%, and so on.

This way, you and I would have caught the $64K peak without trying to time it perfectly. In conclusion, the correct time to sell Bitcoin after halving is supposed to be strategic. Set multiple price targets and stick to them.

Buy or Sell Crypto Indicator (3 Rules)

Technical indicators like RSI (Relative Strength Index), MACD, and moving averages can help signal whether to buy or sell. I use three simple rules that have saved me from major mistakes:

- RSI above 70? Time to be cautious (like when Bitcoin hit $69K)

- RSI below 30? Start buying gradually (remember March 2020?)

- MACD crossing up? Usually means momentum is building

These aren’t crystal balls, but they’ve helped me avoid buying tops and selling bottoms.

Should I Sell My Crypto for a Loss?

Selling your crypto at a loss can feel discouraging. I remember selling some Bitcoin at $6,000 in 2018 after buying at $15,000. It felt awful, but here’s why it sometimes makes sense:

- Tax-loss harvesting: You can offset capital gains by reporting losses on your tax return. (saved me $2,000 that year on my tax bill?)

- Reallocation: Free up capital for stronger-performing assets. Reinvest in stronger projects that recovered faster

- Risk control: Sometimes your original thesis was wrong, and admitting it saves you from bigger losses.

Still, don’t rush. Holding may yield better returns than locking in a loss if you believe in Bitcoin’s long-term value.

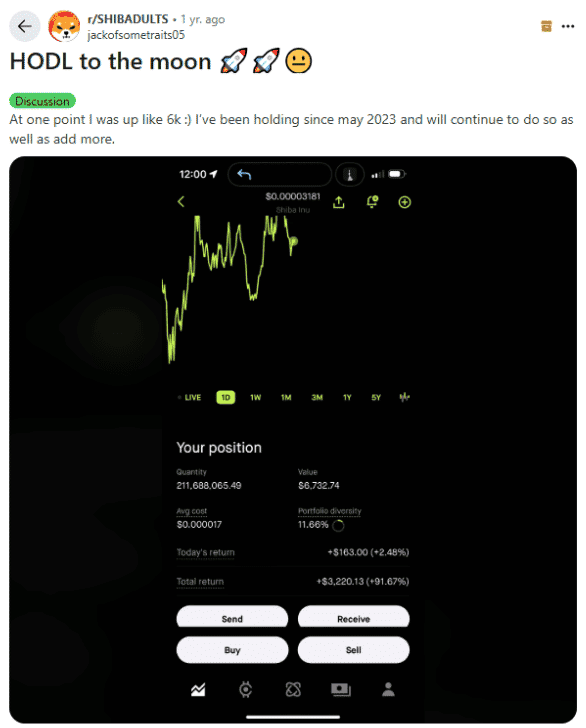

Should I Sell My Bitcoin Today (Reddit Insights)

The Reddit crypto community is like that friend who gives you both the best and worst advice possible. I spend way too much time on r/Bitcoin and r/CryptoCurrency, and here’s what I see:

1. During crashes: Half the comments are “HODL to the moon!” while the other half are “I’m selling everything, this is over!” Neither extreme is usually right.

2. During pumps: Everyone’s a genius, and crypto is going to $1 million next week.

3. The actually useful stuff: Real people sharing their exit strategies, tax situations, and lessons learned. For example, the guy who shared how he pays his kid’s college tuition by selling 5% of his Bitcoin every semester.

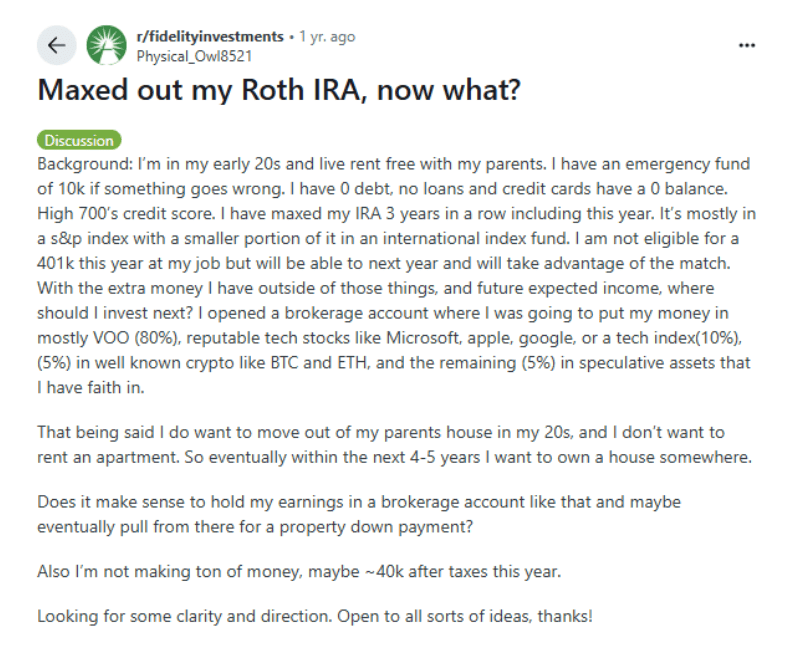

Or, the Redditor invests in VOO, tech, and crypto to grow savings and plans to fund a home down payment in five years.

Pro tip: Read the daily discussion threads, but make decisions based on your own financial situation, not the emotional roller coaster of strangers on the internet.

Suggested Reads:

Final Thoughts

So, should you sell your Bitcoin? There’s no universal answer, but understanding your goals, risk tolerance, and market signals can help you make the right decision.

After five years in crypto and way too many sleepless nights, here’s what I’ve learned: the best Bitcoin decision is the one you can live with. Remember, every situation is unique. Whether you want to take profits, cut losses, or reallocate, your crypto journey should align with your financial plan, not market noise.

Consider consulting with a financial advisor who understands crypto markets. Regular portfolio rebalancing, setting clear profit targets, and having emergency funds outside of crypto can all contribute to a healthier investment strategy.

In the end, the best Bitcoin decisions are informed, deliberate, and aligned with your unique financial situation.

FAQs

Depending on the buying date and market fluctuations, you’d have around $20,000–$30,000 today.

Many analysts expect long-term growth due to rising adoption, institutional investment, and limited supply, but the market remains volatile.

Estimates vary widely—from $80,000 to $250,000—based on adoption, regulations, and market sentiment.

Over $5 million today, assuming you bought at $10 per BTC and held through all cycles.

If you believe in long-term value and can handle volatility, holding may be beneficial. Always consider your risk tolerance.